ABInsight | Great Expectations: A 2017 Market Forecast

Great Expectations: A 2017 Market Forecast

By: Thomas M. Brophy, Director of Research

Let's begin with a few quotes:

"I met a girl who sang the blues

And I asked her for some happy news

But she just smiled and turned away

I went down to the sacred store

Where I'd heard the music years before

But the man there said the music wouldn't play

And in the streets the children screamed

The lovers cried, and the poets dreamed

But not a word was spoken

The church bells all were broken

And the three men I admire most

The Father, Son, and the Holy Ghost

They caught the last train for the coast

The day the music died

And they were singing

Bye, bye Miss American Pie

Drove my Chevy to the levee but the levee was dry

And them good ole boys were drinking whiskey and rye

Singin' this'll be the day that I die

This'll be the day that I die…."

-Don McLean ‘American Pie'

"When you walk around all mopey, m'kay, and sayin' everything is... just shitty, well, that's called bein' a Debbie Downer, Stan. And nobody likes a Debbie Downer, m'kay. ...I mean you've gotta, you've gotta snap out of it, Debbie. Come on, Debbie, you're even bummin' me out now, m'kay? Your attitude just- just sucks."

-Mr. Mackey to Stan Marsh from South Park, Season 15 Episode 8

"It's better to be contrarian for the sake of being contrarian, than to be consensus for the sake of being consensus."

-Jared Dillian, Editor, The 10th Man, Mauldin Economics

"We have forty million reasons for failure, but not a single excuse."

-Rudyard Kipling

2016 in the Rearview

Tis that time of year again when economists, business owners and investors review the year that was and make plans/strategies to implement in the current. 2016 was an absolutely monumental year, if only for the fact that so many people's predictions were proven wrong about so many different things, i.e. from Fed interest rate increases, to Brexit (and Britain's economy taking top spot in the world at the end of 2016), to Trump, to Italy. As an ardent student of history, in particular my own history, I find it highly beneficial to assess my previous forecast to see what I got right and wrong. For those with a penchant for re-reading analysis, you can view my 2016 Forecast here.

On the whole, I would say that most of my assumptions proved true, i.e. Fed did not hike rates, investor interest in multifamily product proved rampant and the Dodd-Frank Reform Act's Volcker Rule did suck liquidity out of the market. For all my correct assertions, I did have a few miscalculations namely, Dodd-Frank's impact on single-family home market recovery (which I had assumed would be more detrimental than proved to be) and, lastly, the major post-election stock market rally which has propelled the Dow to just shy of 20,000.

Interest Rates Rising?

In the start to the oft used colloquialism, which I have modified, "opinions are like…..(economists/analysts) just shop around for the analysis you wish to hear." In any forward looking projection it is impossible to quantify all the various potential permutations or direct/ancillary reactions to any given movement in the market or in government. With that as a qualifier, and on the minds of all investors, what are the chances that the Fed will continue to raise interest rates?

For an answer I would like to turn to Mike Shedlock of Sitka Pacific and his post, ‘Five Reasons Fed Won't Hike Even Twice in 2017.' As the title implies, Shedlock firmly believes, to wit I must agree, there will be no more hikes in 2017. As evidence he states, "The Fed managed to get in one hike in each of the last two years, both in December, vs. Fed assessments of 3-4 hikes each year. For the third straight year, rate hike expectations for the coming year soared in December, only to quickly die at the beginning of the next year. Expect more of the same."

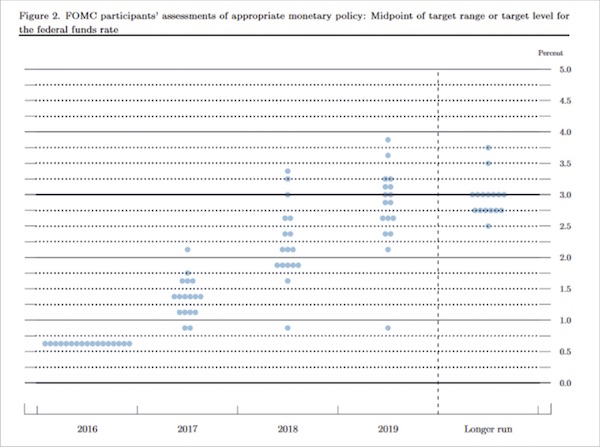

Furthermore, if you look to the FOMC participants' assessments of appropriate monetary policy, i.e. what Fed members think interest rates should be, forward looking into 2019 and long term (see chart below), not one Fed participant believes rates will be higher than 5% again. As John Mauldin would emphasize "Not one!"

Peak Pricing, Now What?

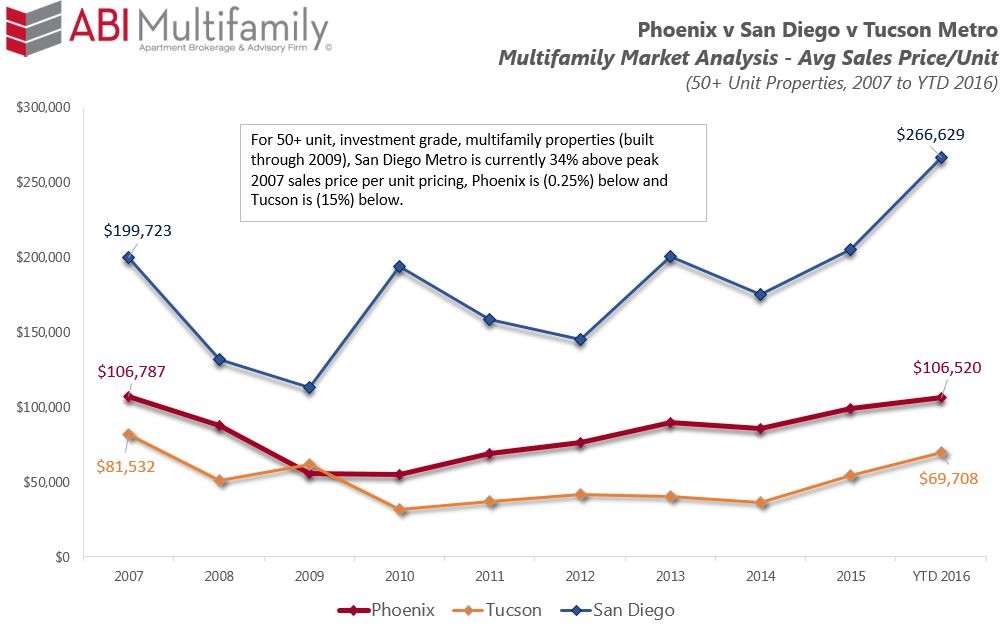

As will be discussed in greater detail in our Year End reports, many markets across the US have surpassed their peak sales price per unit amounts. As the chart below shows, of the markets we currently cover Tucson is the only exception, which as of November 2016, was still 15% below its previous 2007 peak.

As shown in our Phoenix Metro per City Analysis: Rents, Occupancy, Population & Affordability post, despite sustained average per year rental rate increases of approximately 4%, elevated construction amounts (although nowhere near peak building), the Phoenix Metro is at historical highs both in terms of occupancy, trending towards 97%, and renter retention, which at nearly 55% is some 3% higher than the national average. This holds true for San Diego and Tucson as well, albeit to differing degrees.

Dirges in the Dark or A New Hope?

This is where I depart from the usual data sets and analysis to provide a more general, personalized observation of the economy and markets with a few questions for thought to follow. Inasmuch as I'm an observer and analyst of commercial real estate, and have been for over 15 years, I am very much a part of and live in the world in which I'm observing, which includes being a renter. Myself, like many in my generational cohort, are not renters by choice but rather by circumstance, specifically having been financially decimated in the 2008/09 crisis. It took myself, and many close friends/associates, nearly 10 years to settle most of our debt claims stemming from the fall and many of us will continue to have credit issues well into 2020. At first, we truly lamented our lot as renters both for superficial, such as status, and more practical, such as wanting to paint a wall or update a look, reasons. Having now rented for the better part of 8+ years, and despite sustained rental rate increases and general housing annoyances, which we also remember came from owning, has shifted our perceptions of renting. In addition to renter's changing attitudes so too have apartment owners/investors changed the way they manage and build/rehab their properties.

I believe that we are living through a tectonic demographic shift pushing us further and further into a more renter-centric society, which started in earnest in 2011/12 and what we at ABI have coined ‘The Decade of the Renter.' I'll make no assertions whether this shift is good or bad, but make no mistake that it is happening. Never has this sentiment, and general change in societal thought been so cogently explained as it was yesterday at the Belfiore 2017 Annual Housing Report Conference, geared specifically for single family home developers/builders, in Phoenix.

Home builders, over the past several years, have experienced a whole host of issues from double digit inflation rates on materials to increased labor costs due to shortages and, last, but certainly not least, buyers evolving expectations as influenced by their current renting conditions. This sentiment was best expressed at the conference via many conversations builders have had with potential buyers, who lamented the homes lack of lavish furnishings to which the renter/potential buyer had grown accustomed, i.e. 5-piece water shower fixtures, wood/tile flooring, built-in wine fridge etc.

Iffy Questions & a Poem

With interest rates currently spiking, especially from their July pre-election lows, have dampened buyer's ability to afford the purchase of homes. While this spike has impacted the lone, individual home buyer, interest rates do not operate in a vacuum and do impact all people and investors equally when it comes to purchase power. Who do you think stands to benefit more in a rising interest rate environment, single family or multifamily?

If Obamacare is repealed and people are no longer forced to pay its tax, how will those taxpayers use their money? Based on my own situation and if myself and family could switch back to a more HSA + high deductible catastrophic plan banned under current regulations, I could see upwards of $400 more per month ($4,800 per year) in extra income.

If Trump does repeal some of the more draconian aspects of government regulation, helps to usher in more infrastructure projects (think Keystone Pipeline) and works to reduce both corporate and citizen tax rates, what do you think the economic outcome will be?

Will international markets, particularly Europe and Asia, continue their NIRP induced road to perdition? If so, cui bono? And, more importantly, how do you think this will impact domestic markets?

I shall bid you adieu with the following poem entitled ‘If—' whose author, Rudyard Kipling, also penned The Jungle Book:

"If you can keep your head when all about you

Are losing theirs and blaming it on you,

If you can trust yourself when all men doubt you,

But make allowance for their doubting too;

If you can wait and not be tired by waiting,

Or being lied about, don't deal in lies,

Or being hated, don't give way to hating,

And yet don't look too good, nor talk too wise:

If you can dream—and not make dreams your master;

If you can think—and not make thoughts your aim;

If you can meet with Triumph and Disaster

And treat those two impostors just the same;

If you can bear to hear the truth you've spoken

Twisted by knaves to make a trap for fools,

Or watch the things you gave your life to, broken,

And stoop and build 'em up with worn-out tools:

….

If you can talk with crowds and keep your virtue,

Or walk with Kings—nor lose the common touch,

If neither foes nor loving friends can hurt you,

If all men count with you, but none too much;

If you can fill the unforgiving minute

With sixty seconds' worth of distance run,

Yours is the Earth and everything that's in it,

And—which is more—you'll be a Man, my son!"

-Rudyard Kipling, If—