ABInsight | Phoenix Metro Multifamily Market Tops $4.5 Billion in Sales

ABInsight | Phoenix Metro Multifamily Market Tops $4.5 Billion in Sales

By: Thomas M. Brophy, Director of Research

As I'm sure many of you have read, there has been a significant uptick in the frequency of large deals closing in the Phoenix Metro. It should be noted that a lot of these deals, as with many deals involving large properties, take months to put together and there's usually a rush to deploy capital prior to year-end. Considering the current business climate, with high volatility the world over, has investors seeking safe harbor. If you look at some of the larger deals that have closed, i.e. Biscayne Bay (516 units), Elliot's Crossing (496 units) and numerous smaller deals, in November alone, Phoenix has witnessed just over $320M in multifamily transactions; year-to-date Phoenix just crested $4.5 billion in total transaction volume which is a record for the Metro. A lot of these deals are being fueled, sometimes on the equity or debt or both, by large institutional investors such as life insurance companies, pension funds and REITs needing yield. Phoenix, and to a lesser degree Tucson, with our strong jobs growth and continued population increases have become that safe harbor and I would expect to see more of these deals as the year comes to an end.

Phoenix Crests 2007 Peak Pricing

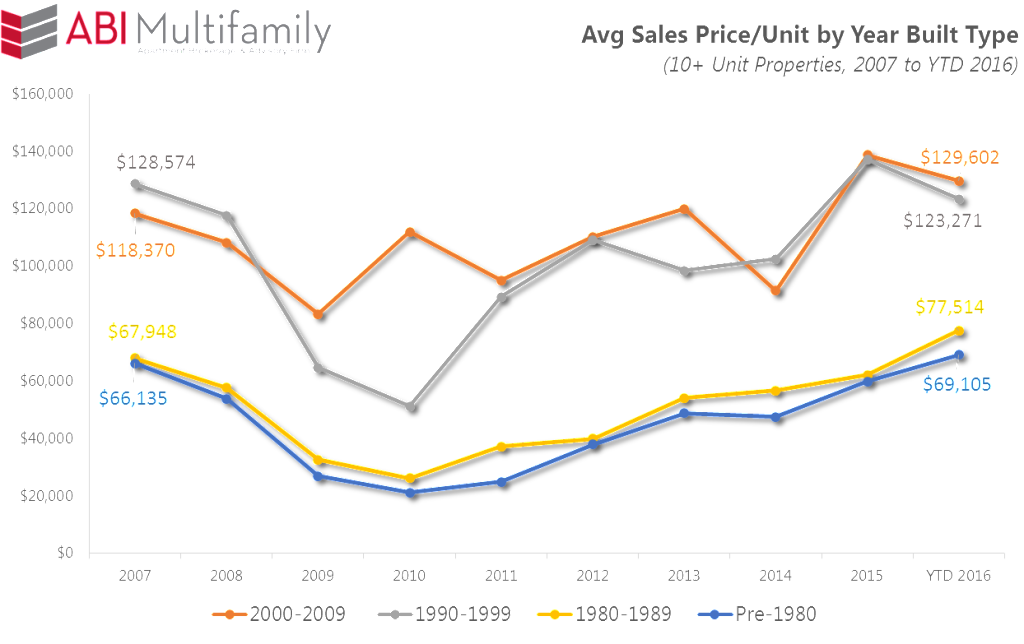

Whereas many markets across the US have already exceeded peak sales price per unit amounts, Phoenix Metro, despite our frenetic sales pace, just crested our 2007 average sales price per unit peak by an average across all year built types by 6%:

As can be referenced in the chart above, 1980's built product has seen the greatest increase rising, on average, 14% above peak 2007 pricing, currently $77,514/unit. 2000-09 built projects are second, in terms of peak-to-peak appreciation, and have risen 9.5% above 2007's $118,370/unit average sales price. In fact, out of all the time periods assessed only 1990's built product is below its 2007 peak, $128,574, resting currently at $123,271, which is 4% below peak.

It stands to reason that 1980's built apartments have seen the greater share of the appreciation trend. First, and this is particularly true in the Phoenix Metro, nearly 30% of our entire apartment housing stock (10+ unit properties) was built in the 1980's. Much of this housing, and their surrounding environs, have witnessed tremendous demographic and economic changes since their construction. Furthermore, multifamily owners/investors not wanting to trudge the expensive and time consuming road of new development have opted for rehab and re-tenant strategies as a way to optimize value, often called the value add play.

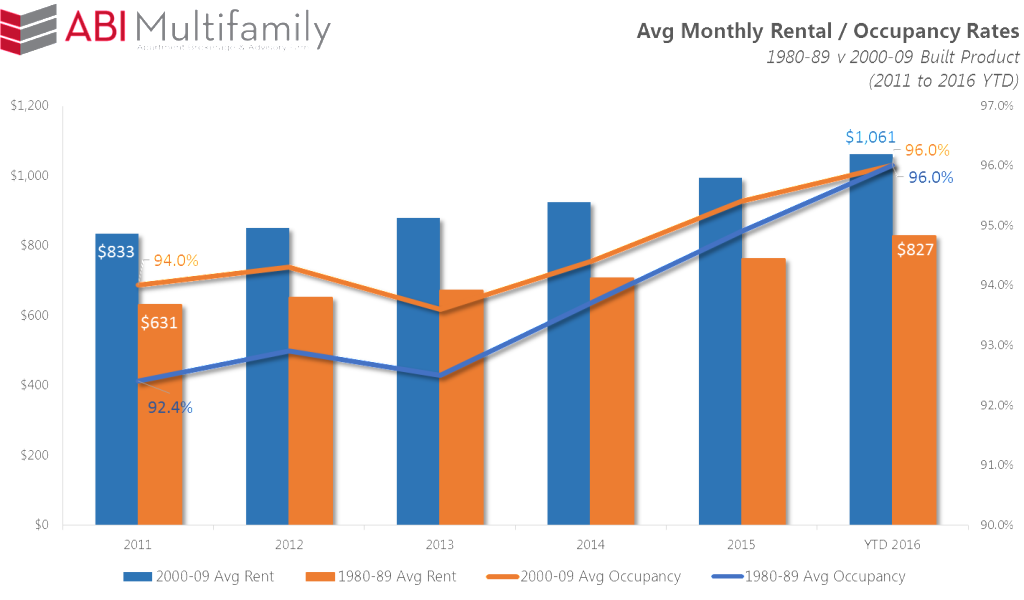

Although both 1980's and early 2000's product have witnessed consistent year-over-year rental rate and occupancy appreciation, 80's product is still, on average, $230 below newer built product. From 2011 to YTD, 1980's product has witnessed average monthly rental rate appreciation of 5.2% per year with an almost 4% jump in occupancy. Conversely over the same time period, early 2000's built product has seen average monthly rents increase 4% per year and a 2% increase in occupancy.

Peak Pricing, Interest Rates Rising, Now What?

As shown in our Phoenix Metro per City Analysis: Rents, Occupancy, Population & Affordability post, despite sustained average per year rental rate increases of approximately 4%, elevated construction amounts (although nowhere near peak building), the Phoenix Metro is at historical highs both in terms of occupancy, trending towards 97%, and renter retention, which at nearly 55% is some 3% higher than the national average. With interest rates currently spiking, especially from their July pre-election lows, have dampened buyer's ability to afford the purchase of homes. While this spike has impacted the lone, individual home owner, interest rates do not operate in a vacuum and do impact all people and investors equally when it comes to purchase power. Nonetheless, with average Cap rates for the Metro still in the 5 to 7% range, contingent upon product type/location, investors still have the ability to withstand marginal increases in rates most likely coming in the next 6 months to a year.

Conclusion

Considering current Fed governor posturing, I anticipate a December rate hike in light of the fact that the market has provided enough defilade, by way of natural increases, to allow for it. Conversely, for the rest of the world, I expect further dives into negative rates which has the potential to set off massive capital flights to preservation as opposed to yield.

Of particular interest, is the Italian Constitutional Referendum vote set for December 6th. Italian PM, Matteo Renzi has staked his claim to power on a ‘Yes' vote but given the current political headwinds the ‘No' vote might very well succeed. To summarize, a ‘Yes' vote would essentially strip the Italian Senate of both its membership and legislative authority, making it more akin to the German Bundesrat, and focusing more national control and power to the Central, i.e. Executive, Government. A ‘No' would keep the power dispersed with opposition leaders vowing to bring a referendum vote to Italy's continued existence in the European Union should they win. As such, volatility shall continue to remain the norm for Europe well into the foreseeable future, the effects of which will continue to drive domestic markets, particularly commercial real estate, here in the United States.