ABI News | Phoenix MSA 1Q 2017 Multifamily Review: Of Population, Jobs & Development Types

Of Population, Jobs & Development Types

By: Thomas M. Brophy, Director of Research

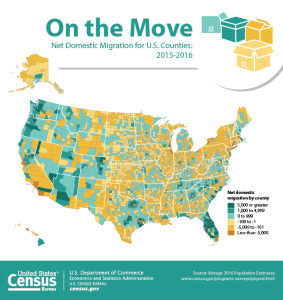

The Phoenix MSA multifamily market had another stellar first quarter fueled by both robust jobs and population growth. In fact, Maricopa overtook Texas' Harris County as top spot for population growth adding 81,000 people, an average of 222 new residents per day, between July 1, 2105 to July 1, 2016. Total nonfarm employment grew by 2.7% led by the leisure/hospitality (+6.2%), financial activities (+6.1%), and education/health services (+2.9%) industries.

Major job/economic announcements for Phoenix, as referenced on the map located on Page 6 of this report, are Intel's plans to invest $7 billion into its Chandler manufacturing plant and hire 3,000+ over the next several years. Other 2016 thru 1Q announcements include: JPMorgan Chase's plan to build a new regional office hub at Tempe's Discovery Business Campus which will house up to 4,000 employees, ADP's new Tempe office to bring 1,500 jobs, Santander Consumer USA's regional operations center in Mesa's Fiesta District set to bring 1,000+ jobs, Orbital ATK's Chandler expansion with 500 new jobs, Clearlink's expansion into Downtown Scottsdale with 500+ jobs, Rogers Corp (NYSE: ROG) global HQ move to Chandler and Kudelski Group's international HQ move to Phoenix just to name a few.

Although Phoenix's emergence from the Great Recession took longer than most expected, beginning in the latter half of 2015 through YTD, Phoenix has experienced a downright boom in job and economic development announcements. At the end of 2016, according to WalletHub's analysis of the 150 biggest cities in the country, five (5) Phoenix MSA cities cracked the Top 20 of best places to find a job: Scottsdale (#1), Chandler, (#7), Tempe (#9), Peoria (#11) and Gilbert (#18).

Phoenix Market Metrics: Got Sales?

The MSA's total sales volume (10+ unit properties) increased 28%, year-over-year, to $780.87 million across 74 transactions representing 7,908 total units sold. California-based investors continue to be the dominant buyer of multifamily properties in the Valley accounting for 31% of total units transacted or 2,486 units, Arizona-based investors came in 2nd with a little over 1,000 units purchased and, rounding out the top five: (#3) Utah-investors with 976 units purchase, (#4) Canadian investors with 874 units and (#5) New York-based investors with 772 units.

Sales of 100+ unit properties led the multifamily investment landscape increasing 35% y-o-y to $684.3M with a marginal contraction in average price per unit amounts of approximately (7%) to $101,789. Whereas 100+ unit properties saw sales volume increase and price per unit amounts decrease, 10 to 99 unit properties saw its volume dip (6%) to $96.5M with a surge of 34% in average price per unit amounts to $81,472. Reason for the average price per unit increase stems, in large part, to smaller, extensively repositioned properties coming back online for sale.

How Does Development Type Affect Deliveries?

As with much of the country, Phoenix area construction deliveries continued to increase rising 37% to 1,794 units delivered. As a result of increased deliveries, particularly in the Mid-to-High Rise building type category, resulted in an Occupancy Rate contraction of (0.7%) to 94.9%. As noted in our August 11, 2016, ABInsight article, "Phoenix Rising from the Garden-Style Apartment Community," Phoenix is in the middle of a development type maturation, i.e. from one primarily focused on Garden-style to one more dominated by Mid-to-High Rise developments. For context, at the end of 2015, the Phoenix Metro was home to 29 Mid-to-High Rise developments accounting for 7,062 units. By the end of 2016, that increased to a total of 42 developments representing 10,057 units which is a 42% y-o-y increase. Of the projects currently under construction (50+ units in size, with delivery through 2019/20), the Mid-to-High Rise category is set to nearly double with the addition of 37 projects or 10,216 units.

Phoenix's trailing 5-year unit delivery rate average had been trending in the 30 to 40 units per month per project through early-2016 which was nearly 70% below peak, pre-Great Recession delivery amount of 120 to 150 units per month. However, as taller projects have hit the market average delivery rate has increased almost 100% to approximately 70 units per month. The net result of increasing delivery levels led to the contraction in occupancy seen at the end of 1Q 2017. Despite the slight occupancy contraction, average rent for the MSA increased 5.6% to $977.

Going forward, it should be expected that the average delivery rate of units will increase towards the 90 to 110 units per month per project range which should have a corresponding impact on occupancy rates and concession amount offered by developers. Nonetheless, Phoenix area developments averaged a lease rate of 17 units per property per month, a 30% y-o-y increase, by end of 1Q 2017. Although Phoenix saw an increase of 15% in the amount of units under construction, ‘Planned' projects witnessed their largest five year contraction dropping some (27%) to its current 14,834 units.

The Road Ahead

As stated in our 2017 Market Forecast, it is unlikely the Fed will continue with its gradual interest rate increase in 2017 despite many economists predicting otherwise. Basis for this sentiment is rooted in weak preliminary 1Q GDP which at 0.7% growth is the slowest in three years, significant instability in international markets, particularly Europe and Asia, and domestic policy struggles of the new Trump Administration. Despite stocks hitting all-time highs, based in large part on investors factoring in massive deregulation, markets the world over have been prone to ever increasing volatility fits.

As a result of high market volatility, and both ancillary observed evidence within our client base and Investment Company Institute's Investment Company Fact Book publication, middle age-to-older market investors have been switching to a combination of passive ETF funds, a now decade-long trend, and purchasing a mix of closed-fund shares and/or direct investments in real estate to provide a more consistent return. This change in investor sentiment, ceteris paribus, will continue to propel real estate transactions, particularly multifamily, into the foreseeable future.

Phoenix multifamily's greatest competitor, single-family home construction, although rebounding, is still far from normal. As was stated at the 2017 Belfiore Annual Housing Conference, and reiterated at the Infill Conference, home builders have been struggling with a whole host of issues from labor shortages, rising material costs and lack of available land, particularly in more urban core areas where people want to live. Of particular note at the Belfiore Infill Conference was consensus among builders/developers/investors that the wave of Californians moving to Arizona has only just begun. As Silicon Valley has increasingly morphed into the Silicon Desert, looking for qualified staff and more amendable business climate, it was only a matter of time before individuals started to march with their feet with Arizona, specifically Phoenix area, as their top destination. Despite significant headwinds, particularly those outside the MSA, and barring any Black Swan events, Phoenix multifamily should continue growing well into 2017/18.

To view the entire Phoenix MSA 1Q 2017 Multifamily Report go to: http://abimultifamily.com/abinsight-phoenix-msa-multifamily-1q-2017-quarterly-report/